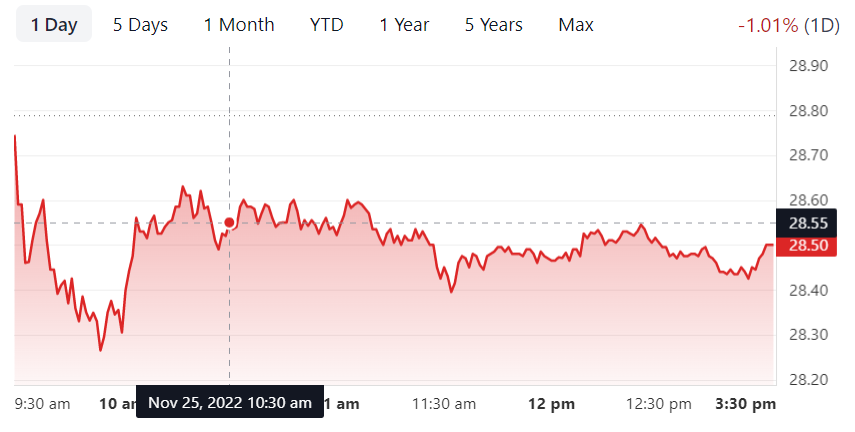

On the last day (Friday, November 25, 2022), Uber Technologies, Inc stock price fell by -1.16% from 28.84 to 28.50. The stick fluctuated around 2.27% with a day high of $28.88 and a day low of 28.24 during the last trading day.

UBER price has been going up and down, and for the last two weeks, there was a -1.8% loss. The stock volume dropped on the previous day alongside UBER stock. This is a good sign because volume must follow the stock. The trading dropped by -5 million shares on the last day. Overall, 5 million shares were sold and bought for around 152.67 million.

Technical Analysis

Uber Technologies stock lies between a wide and falling trend short term. A further fall is also signaled within the trend. The stock is forecasted to fall -5.58% during the next three months, given the current short-term trend. The probability of 90% of keeping the price between 22.39 and 29.88 after three months.

Although there is a sell signal from the short-term moving average, the UBER stock holds a buy signal from the long-term moving average. The short-term average is found above the long-term average; the stock has a general buy signal. This gives a positive stick forecast.

Uber stock will find resistance from around the $28.69 short-term moving average on further gains. As with a fall, the stock will meet some support from the approximately $27.89 long-term average.

A short-term average break-up will send a buy signal, while a long-term average breakdown will send a sell signal. On November 22, 2022 (Tuesday), there was an issuance of a buy signal from the pivot bottom point. So far, that signal has increased by 2.19%.

Also, there was the issuance of negative signals that could influence the close short-term development. Currently, there is a sell signal from the 3-month MACD (moving average convergence divergence). During the last trading day, the price fell together with the volume. This helps reduce the risk since volume must follow the stock price movements.

From the accumulated $27.82 volume, Uber Technologies, Inc finds support, and it can create a buying opportunity. This is because there is an expected upwards reaction once the support is being tested. UBER has average movements and good daily trading volume, which results in a medium risk.

The stock moved 2.27% or $0.640 between the low and high. The stock has had an average 2.94% volatility for the last week. Many analysts recommend a -5.21% or $27.01. As mentioned, UBER has medium daily movements, giving a medium risk. There is also a buy signal found from a pivot bottom two days ago.

Based on the previous stock performance of Uber Technologies, analysts expect to open at $28.54 from the upcoming trading day on November 28, 2022 (Monday). During the day, Uber is expected to move between 27.04 and 29.96 based on the 14-day average true range, giving a potential +/-5.11% (+/-$1.46) trading interval up or down from the latest closing price.

If UBER successfully takes out the entire calculated potential swing range, an estimated 10.21% between the highest and lowest trading price is expected during the day. Since UBER stock is closer to the resistance from the $28.81 accumulated volume than a $27.82 support, no risk/reward intra-day is attractive. So, any bets must be held until UBER gets closer to the support level.

Analysis Conclusion

On Friday, Uber Technologies closed down 1.01% with a 10% normal volume. It showed several range contractions during the trading session as the stock price made an NR7, which was the last seven sessions’ narrowest range. The stock successfully bounces off its 200-day moving average, which is a critical long-term support line.

FAQs

Is UBER stock a buy?

Although UBER holds some positive signals, analysts do not find them sufficient reason for the stock to be a buy candidate. Based on its current level, the stock must be considered a hold candidate while waiting for further development.

Is Uber a good investment in 2022?

The answer is yes if you think free cash flow will continuously go higher and get closer to $4 billion to $ 5 billion yearly this decade. Currently, Uber has a total of $44.3 billion market cap.

Will Uber stock rise?

Based on the 12-month price forecasts, Uber has a 45.00 median target with a low estimate of 32.00 and a high estimate of 75.00. The median estimate is a representation of a 57.95% increase from the last price of $28.50.

Is Uber stock a good investment?

Currently, Uber stock is worth nibbling. Although the stock has yet to be a fantastic buy, the business continuously recovers. It has a surprising resistance to inflationary headwinds.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.