Since October, the German DAX Index’s sharp 20% gain suggests no changes in the medium-term bullish fortunes. That is despite losses this year. But given the overbought conditions, the index could slightly retreat in the short-term.

The Index held very strong converged support in September on the weekly charts. This results in a 50% retracement for 2020-2021 while a horizontal trendline in early 2022. The 38.2%-5-% retracements are often seen as reasonable after a strong bull run.

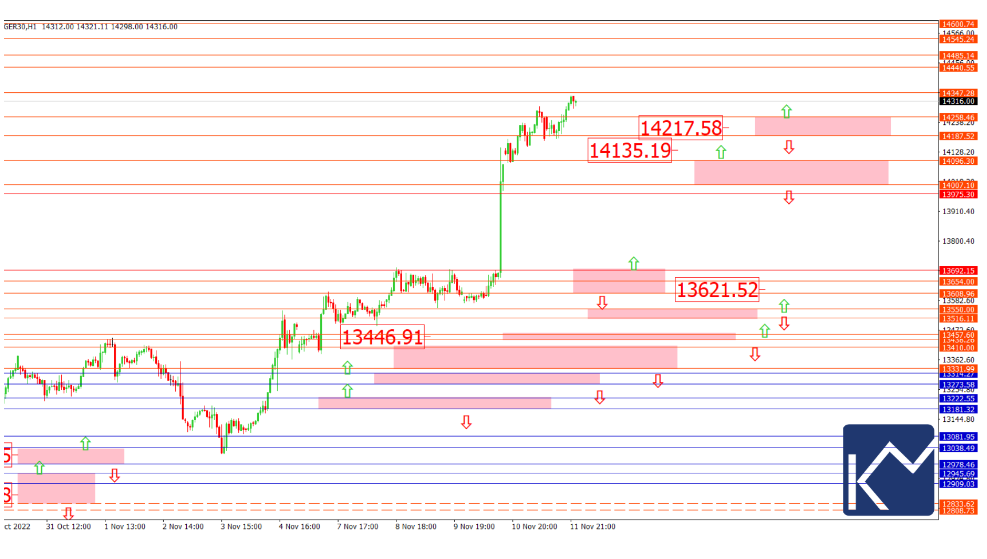

DAX 40 rises higher before it stalls at 14173. This is after the softer-than-expected US inflation data came.

Technical Analysis

The annual inflation rate ended at 7.7%, with the core CPI dropping to 6.3%. This displays promising signs of easing. On the downside, there was a reaction in equity markets after the major stock indices soared.

S&P 500 gained more than 4% while DAX 40 followed closely behind as expectations of the 5th rate hike dissipated. While the German index traded 3.2% higher a week ago, a weaker dollar and lower US yields continuously drive equities.

Last week closed higher in the US and Europe after the release on November 10 of the inflation figure, having slowed to +7.7% last month. The reaction of the markets was considered abrupt, which caused the US dollar to lose against all currencies. Meanwhile, Wall Street sets a record for the best daily session since 2020.

However, the recession’s specter remains being feared. On Friday, the GDP of UL contracted by 0.2%, and the inflation in Germany last month upsurged as expected by +10.4%.

Most investors focus on macro data (unemployment, ZEW Index, GDP) this week. They particularly concentrate on the Eurozone inflation rate. Sharp fluctuations are also expected in GILTS and the pound because of the presentation of the new fiscal plan of the UK by Finance Minister Hunt and PM Sunak.

On November 18, analysts expect inflation data in Japan, affecting the USD/JPY pair.

The uptrend that started close to the mid-October setup is continuously fueled by intraday. Similarly, the uptrend lasted a long period in time and price.

As expected, stock markets have run strong after some indecision over the past few weeks. This makes everyone curious about when retracement will occur in the international markets.

The monthly setup expiration helped analyze the current trend. If something will not change or the stock exchanges will not come to a standstill, the highs marked in August will exceed the minimum targets by the end of November.

Although it can be the first step, this move could potentially create this decade’s low. Also, it could lead to forming the pre-crisis highs by April 2023. This event would not be an exception since the 25/30% declines have been reabsorbed within 12/18 months from forming the pre-crisis high.

Markets drove down for several reasons: rising interest rates, inflation, and the war in Ukraine. These things remain evident. On the other hand, improvement is expected. Markets noticeably move earlier compared to geopolitical issues and the business cycle. If not resolved, current problems are at least scaled back in the next few months. The rate hike is also expected to end in a few months.

Continual descent is possible if the stock markets go below the October low. Also, if stocks continue to rise, the global stock market (20% Asia, 30% Europe, 50% America, and emerging countries) is expected to obtain a positive streak lasting 18-24 months.

Conclusion

The German Index continues to be bullish, reaching levels that were not seen since June 9 – 14347 area. As with the weekly support, it is found in the 13621 area. After the FED inflation data came, DAX created a massive volumetric gap.

FAQs

What influences DAX 40 price?

The DAX Index is weighted by a market cap like other blue-chip indices. A company with a higher market cap has more influence on its value. The prices used for computing the index come from an electronic trading system called Xetra.

How do you trade DAX 40?

You can trade stocks of a company that makes up a DAX. But it can be time-consuming. Alternatively, you can work with brokers offering ETFs or mutual funds that include DAX stocks.

What is the most volatile time for DAX?

Tuesday (2.29% or 313 points) is the most volatile day, while Monday (2.05% or 282 points) is the least volatile day.

What is DAX 40 index?

DAX 40, also known as GER40 or Deutscher Aktien Index, refers to a stock representing 40 of the most liquid and largest German companies trading on the Frankfurt Exchange.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.