Litecoin prices noticed a sharp rise in the past few weeks. The price of Bitcoin’s little brother has previously increased substantially in spite of the bear market. That sharp increase came as a massive shock, while most other coins struggled to rise.

But what’s the reason behind Litecoin’s price increase? Here’s everything you need to know.

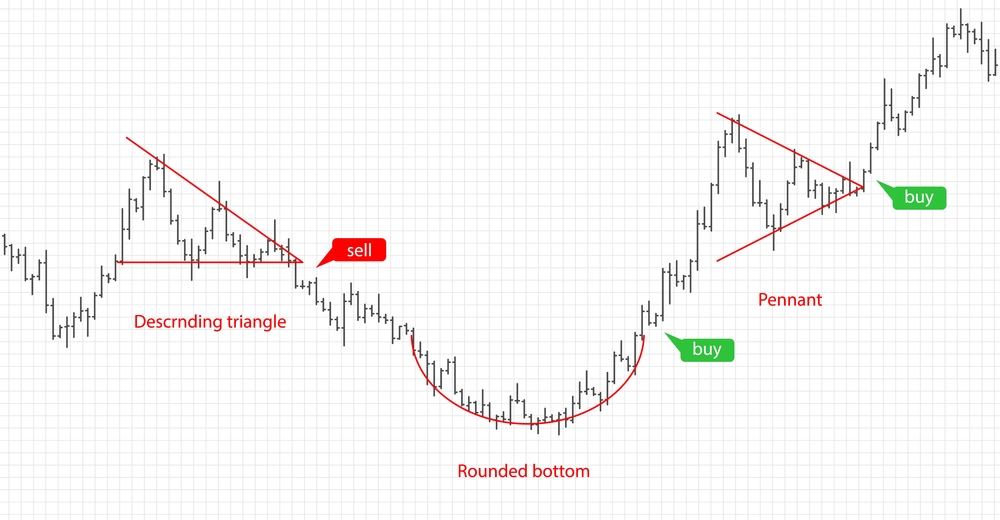

Technical Analysis

The Litecoin price analysis demonstrates that the LTC price action finds solid resistance at the $80 market, and it has withdrawn to the $75 support level.

What’s more, the broader crypto market noticed a negative market sentiment over the past 24 hours as many major cryptos recorded negative price movements. Numerous major players, such as XRP and DOGE, recorded a 7.38 and 8.83 percent decline, accordingly.

The MACD is bearish at the moment, as shown in the red color of the histogram. Nonetheless, the indicator also proves that there is low bearish momentum, as shown in the low depth of the histogram. Meanwhile, the darker shade implies a growing bearish momentum and shows that the price is going downwards.

Presently, the EMAs are trading high above the mean position as net price movement over the previous ten days stays positive. Still, the selling activity is bound to increase as the two EMAs move downwards and diversify.

At the moment, the 12-EMA is leading the run toward the mean line implying a growing bearish activity in the markets.

On top of that, the RSI increased high yesterday as the index climbed to the overbought level but has since reverted back towards the mean position. Presently, the index floats at 58.85, along with a minor upwards slope.

The indicator problems no signals, while the subtle slope demonstrates low market pressure.

Also, the Bollinger Bands were wide lately as the price noticed sharp bullish activity. Still, the bands have begun to converge around the level as the price faces sturdy resistance at the $80 mark. At press time, the bottom line of the indicator offers support at $64.41, while the upper limit shows a resistance level of $86.34.

Overall, the four-hour Litecoin price analysis concerns a buy signal, along with eleven and twenty-six major supporting the bulls. On the other side of the story, five of the indicators back up the bears demonstrating substantial bearish presence in the past hours. Simultaneously, ten indicators sit on the support and fence on neither side of the market.

The 24-hour Litecoin price analysis doesn’t share that sentiment and issues a sell signal along with fourteen indicators implying a downward movement against five indicators recommending an upwards movement.

On top of that, the analysis demonstrates bearish dominance across the mid-term charts during the low-buying pressure for the asset throughout the same timeframe. In the meantime, seven indicators stay neutral and don’t issue any signals at the press time.

Analysis Conclusion

The Litecoin price analysis only shows that the bearish pressure causing the price to fall to $75 has mainly evaporated as the bulls are trying to make another effort at the $80 level.

Cryptocurrency traders expect Litecoin to move up toward the $80 mark, where the key resistance lies. Also, the bullish breakout would allow the price to stabilize at the level and increase to $85. The recommendation is reinforced by the mid-term technical.

Still, in case of any rejection, the price could be expected to see a sharp decline to the $70 level.

FAQs

Q: Is Litecoin a decent investment?

Litecoin has a great future in the cryptocurrency market. Even though it’s not within the most traded crypto assets, it’s widely accepted and simple to trade. It also has a market cap of about $4.12 billion in mid-November 2022.

Q: Which is better, Ethereum or Litecoin?

The major difference between the two is that Litecoin was mainly designed for peer-to-peer payments. Meanwhile, Ethereum is set up to handle more elaborate transactions like loans and could even support software applications.

Q: Will Litecoin increase in value?

Crypto experts are continuously evaluating the crypto’s fluctuations. Based on their predictions, the projected average LTC price will be about $391.25. it might decline to a minimum of $387.04, but it still might reach $448.73 throughout 2027.

Q: What makes Litecoin special?

Litecoin produces blocks every 2 ½ minutes, which is 4x faster than Bitcoin’s block mining time of ten minutes. As such, Litecoin’s network can accomplish greater throughout.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.