Cryptocurrencies are reshaping the financial landscape, and NEO is one of those leading the charge. Understanding the price dynamics of NEO can help investors and traders make informed decisions. In this world of digital currency, NEO has positioned itself as a prominent player. This article will delve into the details of NEO’s price analysis, so buckle up for an enlightening ride!

The Chinese market has always been at the forefront of technology and innovation, and NEO, often referred to as “Chinese Ethereum,” is no exception. Being involved with NEO is more than just a financial venture; it’s being part of a revolution that’s changing the face of global economics.

Contents

Historical Overview

NEO’s inception in 2014 marked the beginning of a remarkable growth trajectory. Once valued at just a few dollars, its worth has seen highs and lows, reflecting the volatility of the crypto market. Remember when NEO was worth just pennies? Those were the days! But since then, NEO’s journey has been nothing short of a rollercoaster.

From its early days to recent times, NEO’s price has been influenced by various factors including technological advancements, regulatory changes, and global economic conditions. Its historical performance sets the stage for understanding its current standing and future potential.

Current Market Overview

The ever-changing landscape of the crypto market puts NEO in a unique position. With a market cap that ranks it among the top cryptocurrencies, NEO’s current market position reflects both its utility and adoption. The road to the top is never easy, and NEO’s journey is filled with lessons for both seasoned investors and newbies alike.

The demand for NEO isn’t just about its financial value; it’s a reflection of a shift in how we view currency, technology, and innovation. The way we do business is evolving, and NEO is at the forefront of this digital transformation. Keeping an eye on NEO’s current market position isn’t just smart; it’s essential for anyone involved in the crypto space.

Technical Analysis

- Tools Used

Technical analysis involves using various tools like charts, trend lines, and moving averages. Analyzing NEO’s price using these tools is like trying to predict the weather; you have indicators and patterns, but surprises are always around the corner! Understanding these tools can turn the seemingly random movements of NEO’s price into a comprehensible story. - Patterns

Recognizing patterns in NEO’s price movement can be akin to reading a story where the ending is the price! From head and shoulders to double tops, these patterns reveal trends that might otherwise be invisible. Just like deciphering hidden messages, understanding these patterns gives you insights into what’s likely to come next. - Indicators

Indicators such as RSI, MACD, and Bollinger Bands are like the spices in a recipe, adding flavor to your analysis. Using them helps in predicting future price movements, like adding herbs to a dish brings out the flavor. Recognizing the right indicators is an essential skill, akin to a chef knowing exactly which spice will perfect the meal.

Fundamental Analysis

- Market Demand

Understanding the demand for NEO is like knowing why people line up for a blockbuster movie. It’s not just about the star cast; it’s about the plot, the director, the music, and so much more. Similarly, NEO’s demand isn’t just about its price; it’s about its technology, its vision, its leadership, and its role in the new digital economy. - Regulation

Regulatory shifts can be game-changers for NEO’s price, like a sudden twist in a novel that changes everything. Regulations in the crypto world are like ever-changing traffic rules on the digital highway. Understanding them is not just about obeying the law; it’s about knowing how to navigate the landscape and reach your destination successfully. - Macro Factors

Economic conditions and global events can sway NEO’s price like wind sways a tree. Whether it’s a political shift, a change in interest rates, or a natural disaster, these factors can send ripples through the market. Being aware of these macro factors is like having a weather forecast; it helps you prepare for what’s coming, so you’re not caught off guard.

Recent Developments

Staying updated with the latest news affecting NEO is like watching a thrilling series where each episode brings new surprises. Technology upgrades, partnerships, and even political changes can significantly impact NEO’s price. Being abreast of these developments ensures you’re never left in the dark.

From technological advancements to strategic partnerships, NEO’s recent developments paint a picture of a dynamic and evolving entity. The landscape is ever-changing, and NEO is not just adapting; it’s thriving. Understanding these developments is like having a backstage pass to a concert; you get to see how the magic happens!

Future Projections

- Short-Term Forecast

Predicting NEO’s immediate future is like forecasting tomorrow’s weather. You have data, models, and expert opinions, but surprises are always possible. Understanding the short-term trends helps in making timely decisions, whether you’re an investor looking for quick gains or a trader trying to catch the right wave. - Long-Term Forecast

Projecting NEO’s long-term future is akin to planting a tree and predicting how tall it will grow. You have the soil, the seed, the weather, and the gardener’s expertise, but nature always has the final say. Understanding these long-term trends is like having a roadmap to the future; it helps in planning, strategizing, and preparing for what lies ahead. - Potential Risks

Investing in NEO without considering the risks is like driving without a seatbelt. From market volatility to regulatory uncertainties, the road to crypto success is filled with potential pitfalls. Recognizing these risks isn’t about being pessimistic; it’s about being realistic and prepared. It’s the difference between a well-planned journey and a reckless adventure.

Community Sentiment

The sentiment of the NEO community can either be the wind beneath NEO’s wings or the storm that capsizes the ship. It’s the heartbeat of the ecosystem, the pulse that gives life to the market trends. Engaging with the community is not just about being social; it’s about understanding the forces that drive the market.

Feelings, opinions, and attitudes within the NEO community act like a living, breathing entity. Understanding this sentiment is like tuning into a radio frequency that broadcasts the voice of the people. It’s this voice that can guide, inspire, or warn you. It’s the collective wisdom of those who are on the same journey as you.

Conclusion

Understanding NEO’s price requires a blend of technical prowess, fundamental insight, and keeping a pulse on the world around us. It’s like being a detective, economist, and psychologist all rolled into one. From understanding historical trends to predicting future possibilities, NEO’s price analysis is a thrilling adventure.

Investing in NEO isn’t just about numbers; it’s about understanding a revolution that’s reshaping the world. The information provided here isn’t just data; it’s wisdom that can guide you in this exciting journey. Happy investing, and may your decisions be as innovative and visionary as NEO itself!

FAQs

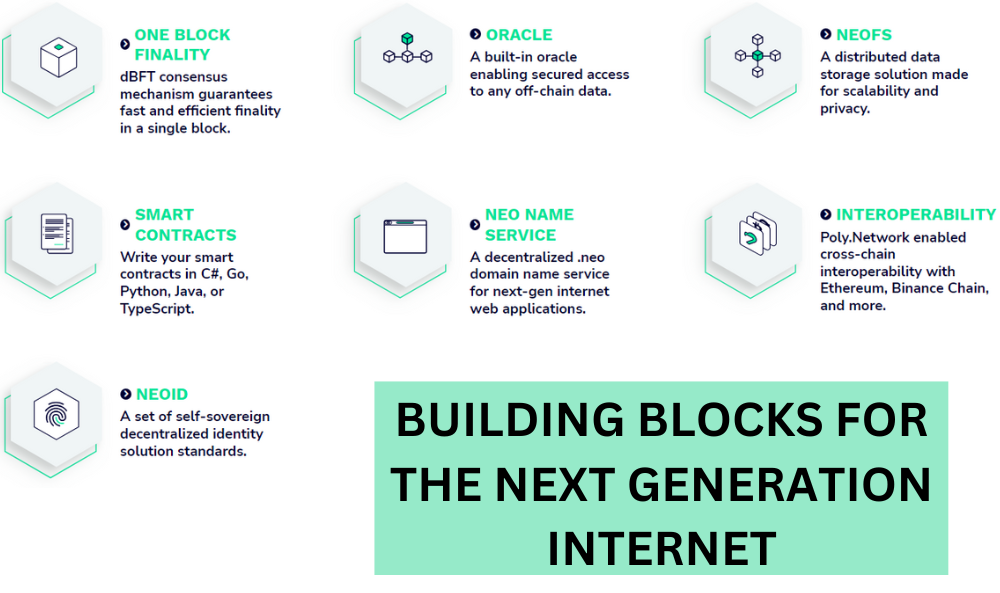

NEO is a blockchain platform that enables the development of digital assets and smart contracts. Often referred to as the “Chinese Ethereum,” it aims to create a smarter economy by bridging the gap between digital and traditional assets.

Investing in NEO is possible through various cryptocurrency exchanges where it’s listed. You’ll need to create an account, deposit funds, and then purchase NEO. It’s akin to buying stocks online, but with its unique twists and excitement.

Tools like charts, trend lines, and indicators such as RSI, MACD, and Bollinger Bands are commonly used in technical analysis of NEO. These tools help to visualize and predict price trends, much like weather instruments help meteorologists forecast the weather.

Macro factors such as global economic conditions, interest rates, political stability, and even unexpected events like natural disasters can influence NEO’s price. These factors act like unseen currents in the ocean, affecting the tides and waves that are NEO’s price movements.

Future projections for NEO are based on a combination of past data, current market conditions, and expert analysis. While these predictions provide guidance, they are not set in stone. Investing in NEO, or any cryptocurrency, comes with inherent risks and uncertainties, like venturing into uncharted territories with a compass and a well-drawn map.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.