In the world of cryptocurrencies, Zcash has emerged as a prominent privacy-centric digital asset. As with any cryptocurrency, its price is subject to a variety of factors that influence its value in the market. In this article, we will delve into a comprehensive analysis of Zcash’s price, exploring its historical context, the key factors influencing its price movements, technical analysis, future predictions, and ultimately, a conclusion on its potential trajectory.

Contents

Historical Overview

Zcash, launched in 2016, stands out among cryptocurrencies due to its privacy features. It was developed to enhance user anonymity by implementing zk-SNARKs, a cutting-edge zero-knowledge proof protocol. These privacy features enable users to conduct transactions with added confidentiality, making Zcash a favorite among privacy-conscious individuals and institutions.

Despite a modest start, Zcash gained momentum over the years, becoming one of the top cryptocurrencies by market capitalization. It weathered the volatile storms typical of the cryptocurrency market and managed to establish itself as a legitimate digital asset.

Factors Influencing Zcash Price

- Market Sentiment: Like any financial instrument, Zcash’s price is significantly influenced by market sentiment. Positive news, partnerships, and developments within the Zcash ecosystem tend to drive the price upward, while negative events can result in price declines.

- Bitcoin Correlation: Zcash, like many other cryptocurrencies, has a strong correlation with Bitcoin. As the pioneer of cryptocurrencies, Bitcoin’s price movements often set the tone for the entire market, including Zcash.

- Regulatory Developments: The regulatory environment plays a crucial role in shaping the future of Zcash. Favorable regulations can boost investor confidence and foster adoption, positively impacting the price. Conversely, adverse regulations can lead to uncertainty and dampen price growth.

- Technological Advancements: Zcash’s continuous development and upgrades impact its price. Technological advancements that enhance security, scalability, and privacy features can attract more investors and traders.

- Market Liquidity: Liquidity is vital for any tradable asset, including Zcash. Higher liquidity leads to smoother price movements and narrower bid-ask spreads, making it more appealing to investors.

Technical Analysis

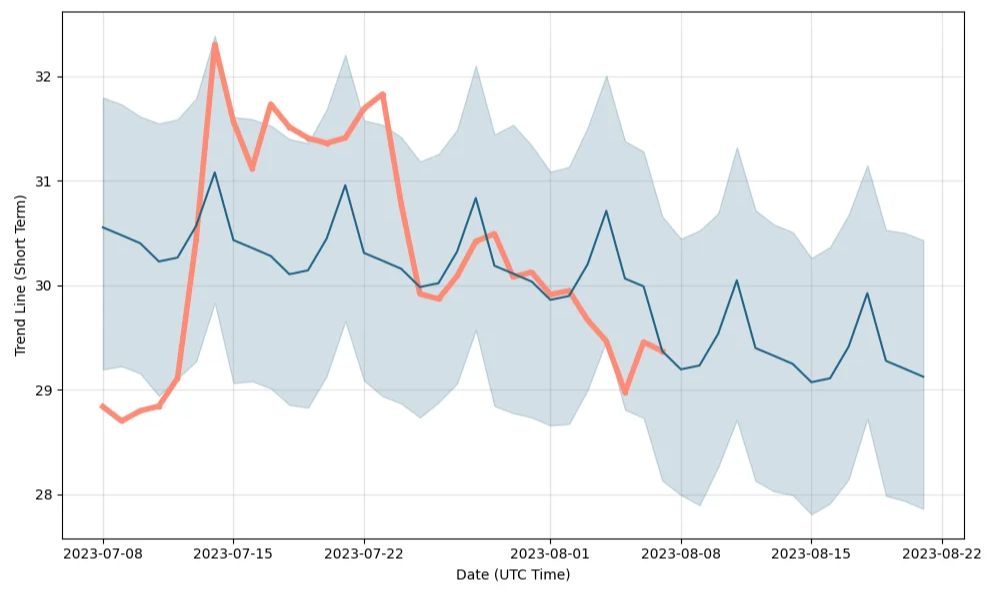

Technical analysis involves studying historical price charts, trading volumes, and patterns to predict future price movements. While it does not provide certainty, it offers insights into potential price directions.

- Price Chart Patterns: Traders often look for chart patterns like ascending triangles, head and shoulders, and double tops/bottoms to anticipate potential breakouts or reversals.

- Support and Resistance Levels: Identifying significant support and resistance levels helps traders make informed decisions about when to buy or sell Zcash.

- Moving Averages: The use of moving averages, such as the 50-day and 200-day moving averages, can signal shifts in the market trend.

Future Predictions

Predicting the future price of any cryptocurrency, including Zcash, is a complex task due to the highly volatile nature of the market. Nevertheless, some analysts suggest potential scenarios based on current trends.

- Bullish Case: If Zcash continues to expand its privacy features and gains wider adoption, it may experience significant price growth, potentially reaching new all-time highs.

- Bearish Case: Conversely, if the privacy-focused market loses traction or faces regulatory challenges, the price could experience downward pressure.

- Steady Growth: Zcash may continue to see steady growth if it maintains a balance between technological advancements and privacy features.

Conclusion

In conclusion, Zcash remains an intriguing cryptocurrency with its privacy-centric approach. Its historical journey showcases resilience in the face of market fluctuations. The price of Zcash is influenced by a myriad of factors, including market sentiment, regulatory developments, and technological advancements. Technical analysis can provide valuable insights for traders, but predicting the future price remains challenging due to market volatility. As the cryptocurrency space evolves, Zcash’s ability to adapt and innovate will be critical in shaping its price trajectory.

FAQs

No, there are several privacy-focused cryptocurrencies, including Monero and Dash, that also offer enhanced anonymity features.

Zcash focuses on privacy, allowing users to shield transaction details, while Bitcoin transactions are transparent and open to anyone.

Zcash can be mined using either traditional Proof-of-Work (PoW) or the newer Proof-of-Stake (PoS) algorithms.

The Zcash community actively participates in its development, proposing upgrades and governance decisions through community forums.

While Zcash’s privacy features can be misused, its primary goal is to protect users’ financial privacy and security, making it a valuable tool for legitimate use cases.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.