In recent years, the world of cryptocurrency has witnessed a surge in popularity and interest. Among the numerous cryptocurrencies available, XRP stands out as one of the most promising digital assets. In this article, we will provide a comprehensive analysis of the XRP price, exploring its historical overview, the factors influencing its price fluctuations, technical analysis, and future predictions. So, let’s dive in!

Contents

Historical Overview

XRP, created by Ripple Labs in 2012, is not just a cryptocurrency but also a digital payment protocol that aims to facilitate cross-border transactions in a fast and cost-effective manner. Unlike other cryptocurrencies, XRP is not mined; instead, it was pre-mined, and a total of 100 billion XRP tokens were created. Over the years, XRP has gained significant attention from financial institutions due to its potential to revolutionize global payments.

Factors Influencing XRP Price

- Market Sentiment: Like any other asset, XRP’s price is heavily influenced by market sentiment. Positive news, partnerships, or regulatory developments can lead to a surge in demand and subsequently drive the price upwards.

- Regulatory Environment: The regulatory landscape plays a vital role in the cryptocurrency market. Uncertainty or unfavorable regulations can create price fluctuations as investors react to potential impacts on XRP’s use and adoption.

- Adoption and Use Cases: The wider adoption of XRP as a medium of exchange or a store of value can have a significant impact on its price. Increased usage in real-world scenarios can boost investor confidence.

- Market Liquidity: Liquidity directly affects XRP’s price stability. A higher level of liquidity provides more room for price movements, reducing the risk of drastic price swings.

- Competitive Market: XRP operates in a competitive market, with several other cryptocurrencies vying for attention. Developments in rival projects can influence investor preferences and impact XRP’s price.

Technical Analysis

Technical analysis involves studying historical price charts and identifying patterns and trends to predict future price movements. While it is essential to consider other factors, technical analysis can offer valuable insights into potential price directions.

- Moving Averages (MA): The MA helps smoothen price data and identifies trends. The 50-day and 200-day moving averages are commonly used to assess short-term and long-term price trends, respectively.

- Relative Strength Index (RSI): RSI indicates overbought or oversold conditions. An RSI above 70 suggests overbought, while an RSI below 30 suggests oversold, signaling potential price reversals.

- Bollinger Bands: Bollinger Bands show price volatility. A narrow band suggests low volatility, while a wide band indicates high volatility, often preceding significant price movements.

- Fibonacci Retracement: This tool helps identify potential support and resistance levels based on key Fibonacci ratios, aiding in predicting price reversals.

Future Predictions

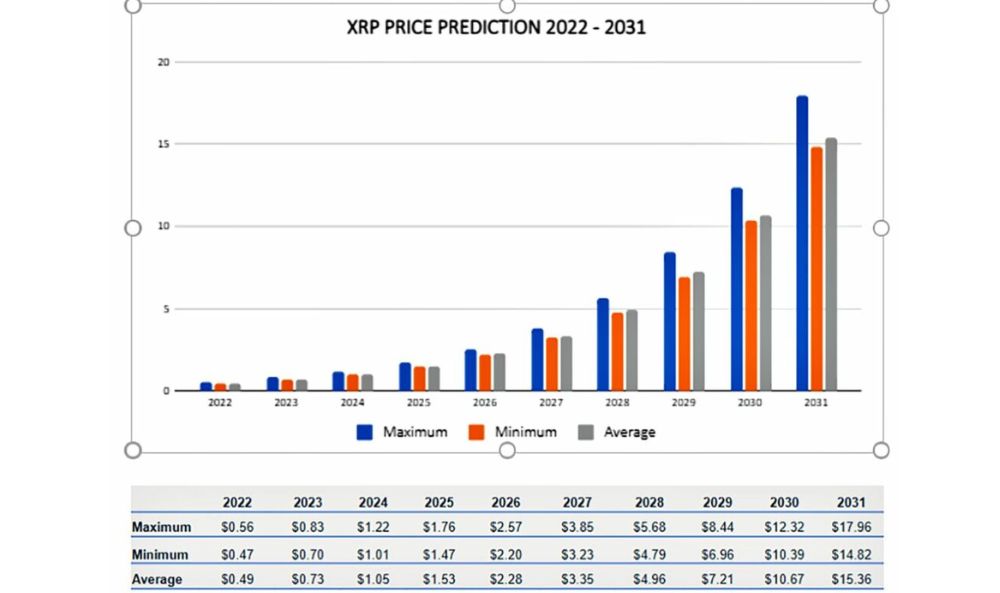

Predicting the future price of any cryptocurrency is inherently challenging due to the complex and rapidly evolving market dynamics. However, some experts believe that XRP’s potential real-world use cases, partnerships with financial institutions, and its utility in cross-border transactions could contribute to its long-term growth.

It’s crucial to keep in mind that cryptocurrencies are speculative investments and can be subject to unpredictable market sentiments. Therefore, it is essential to conduct thorough research and exercise caution when making investment decisions.

Conclusion

In conclusion, XRP has come a long way since its inception, evolving into a promising cryptocurrency with significant potential for revolutionizing cross-border transactions. Various factors, including market sentiment, regulatory environment, adoption rate, and market liquidity, can influence its price movements. Technical analysis can provide valuable insights, but it should be complemented with other fundamental research.

Remember, investing in cryptocurrencies carries inherent risks, and it is essential to make informed decisions and never invest more than you can afford to lose.

FAQs

While XRP shows promise in the long term due to its utility, it is essential to conduct thorough research and assess your risk tolerance before investing.

XRP’s technology has the potential to revolutionize cross-border payments, but its widespread adoption depends on various factors, including regulatory acceptance.

Ripple Labs’ actions, partnerships, and developments can impact XRP’s price, as the company holds a significant portion of the total XRP supply.

XRP can be stored in hardware wallets or reputable cryptocurrency exchanges with strong security measures to protect your investment.

XRP faces challenges related to regulatory uncertainties, competition from other cryptocurrencies, and gaining trust among financial institutions.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.