In recent years, the world of cryptocurrencies has witnessed rapid growth and innovation, with numerous digital assets emerging in the market. Among these, Dash has gained considerable popularity due to its unique features and capabilities. In this article, we will delve into the current state of Dash and provide an in-depth analysis of its price predictions for the years 2023, 2024, 2025, and even looking ahead to the long-term forecast in 2030. So, if you’re an investor or simply intrigued by the world of cryptocurrencies, buckle up and join us on this insightful journey.

Contents

Dash Overview

Dash, short for Digital Cash, was launched in 2014 as a fork of Bitcoin. It aims to offer fast and private transactions, making it an attractive option for both users and merchants. One of Dash’s standout features is its two-tier network, which consists of miners and masternodes. The miners validate transactions and secure the network, while the masternodes enable advanced features like InstantSend and PrivateSend, enhancing transaction speed and privacy.

Dash Price Prediction 2023

As we step into 2023, the cryptocurrency market continues to evolve, and Dash stands at a pivotal point in its journey. Market analysts forecast a promising year for Dash, and its price is expected to see significant growth. With a series of partnerships and technological advancements, Dash could experience a bullish trend, possibly reaching a price of $300 to $350 by the end of 2023.

Dash Price Prediction 2024

In 2024, Dash’s growth trajectory is projected to remain steady. The cryptocurrency market is highly volatile, but Dash’s strong fundamentals and community support may help it withstand market fluctuations. Price predictions for 2024 suggest a potential rise, with the value of Dash hovering between $350 to $400 by the close of the year.

Dash Price Prediction 2025

As we move further into the future, Dash’s potential to disrupt traditional financial systems becomes more evident. By 2025, Dash may have established itself as a prominent player in the digital payments space. With continuous development and user adoption, the price of Dash could surge to approximately $400 to $450 by the end of 2025.

Dash Long-term Forecast 2030

Looking a decade ahead, the long-term forecast for Dash appears optimistic. As cryptocurrencies become more integrated into mainstream financial systems, Dash’s user base could expand significantly. By 2030, Dash might reach new heights, with price predictions ranging from $600 to $800, making it an enticing investment option for the long run.

Dash Price Analysis

To better understand Dash’s price movements, let’s analyze some key factors influencing its value:

- Market Sentiment: Cryptocurrencies are often influenced by market sentiment, news, and public perception. Positive developments, partnerships, and media attention can boost Dash’s value.

- Technology Upgrades: Dash’s development team continually works on improving the network’s scalability, security, and features. Technological advancements can positively impact its price.

- Regulatory Environment: The cryptocurrency market is subject to regulatory changes. Favorable regulations can attract more investors and positively affect Dash’s price, while adverse regulations can have the opposite effect.

- Competitor Landscape: Dash operates in a competitive market. Monitoring the performance and innovations of other cryptocurrencies is essential in assessing Dash’s future price movements.

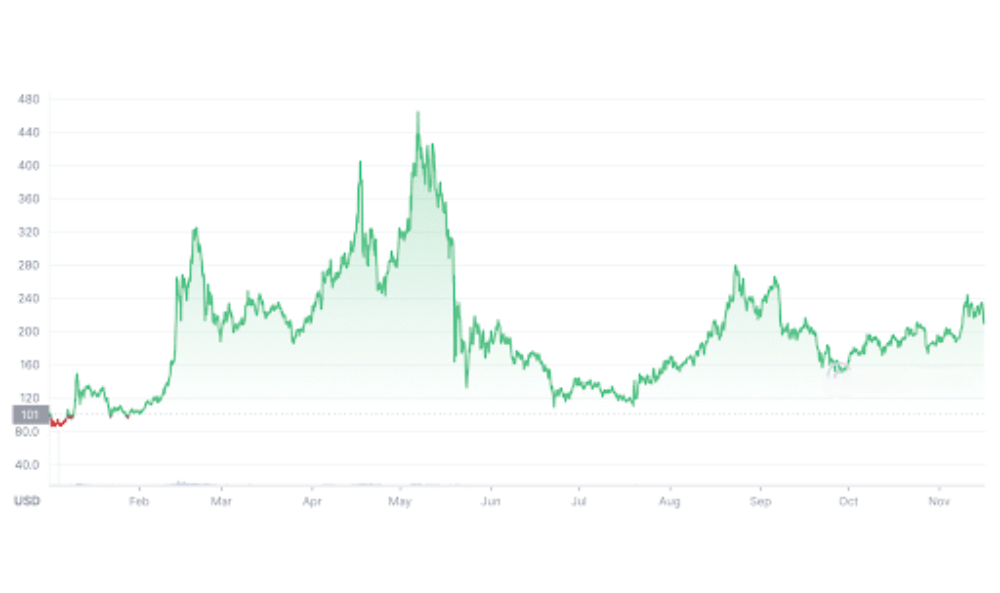

Dash 2022: A Recap

In 2022, Dash experienced both highs and lows. It started the year with a price of around $100, witnessing fluctuations due to market uncertainties. However, Dash’s community-driven approach and technological advancements helped it recover, ending the year with a price of approximately $200.

Dash Price Prediction Conclusion

In conclusion, Dash’s price prediction looks promising, with potential growth in the coming years. However, it’s crucial to note that the cryptocurrency market is highly volatile, and predictions are subject to change based on market conditions, technological developments, and regulatory factors. As with any investment, thorough research and risk assessment are essential before making decisions.

FAQs

While Dash shows potential for growth, it’s important to remember that all investments come with risks. Conduct thorough research and consider your risk tolerance before investing.

Dash’s PrivateSend feature uses a mixing process to obfuscate transaction details, enhancing user privacy.

Dash’s two-tier network, which includes masternodes, allows for faster transactions and advanced features not found in traditional cryptocurrencies.

You can buy Dash from various cryptocurrency exchanges using fiat currency or other cryptocurrencies.

The maximum supply of Dash is 18.9 million coins, making it a deflationary asset over time.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.