In the ever-evolving landscape of cryptocurrencies, Tether has emerged as one of the most popular stablecoins, providing traders with stability amidst the volatility of the crypto market. As we move into 2023, investors and enthusiasts are keen to explore the potential future price movements of Tether. In this article, we will delve into Tether’s historical performance, analyze the current market trends, and present a detailed price prediction for 2023, 2024, and 2025. Furthermore, we will discuss the long-term forecast for 2030 and provide a comprehensive Tether price analysis for the benefit of our readers.

Contents

Tether Overview

Before we dive into price predictions, it’s crucial to understand what Tether represents and its role in the crypto ecosystem. Tether, denoted as USDT, is a stablecoin that operates on the blockchain. Its value is pegged to that of the US dollar, making it a reliable store of value and a preferred choice for traders seeking to mitigate risk during turbulent market conditions. Tether’s primary function is to provide liquidity and facilitate seamless trading of other cryptocurrencies. As a result, it has gained significant traction and is widely used across various cryptocurrency exchanges.

Tether Price Prediction 2023

As we look ahead to 2023, Tether’s price prediction depends on a multitude of factors, including market sentiment, adoption rate, regulatory developments, and macroeconomic trends. Given Tether’s historical stability, it is expected to continue closely mirroring the US dollar, trading at or near its pegged value throughout the year. Barring any unforeseen market disruptions, Tether’s price is likely to remain relatively flat in 2023, fluctuating marginally within a tight range.

Tether Price Prediction 2024

Heading into 2024, Tether’s price prediction sees a potential uptick due to the maturation of the crypto market and increasing demand for stable assets. The crypto space’s growing adoption could lead to heightened usage of Tether in decentralized finance (DeFi) projects, further boosting its value. Additionally, the potential introduction of new use cases or partnerships may drive increased interest and investment in Tether, potentially pushing its price slightly above its pegged value.

Tether Price Prediction 2025

By 2025, Tether’s price prediction suggests a continuation of its gradual appreciation. As cryptocurrencies become more integrated into mainstream financial systems, the demand for stablecoins like Tether is expected to surge. Furthermore, technological advancements and improvements in the underlying blockchain infrastructure could enhance Tether’s utility and security, bolstering its reputation and driving sustained growth in value. However, it’s essential to note that Tether’s price will likely remain closely tied to the US dollar, maintaining its stability.

Tether Long-term Forecast 2030

Looking further into the future, the long-term forecast for Tether in 2030 hinges on the overall health and maturity of the global crypto market. If cryptocurrencies achieve widespread adoption and regulatory clarity, Tether could solidify its position as a go-to stablecoin for investors and traders alike. However, unforeseen economic events or regulatory challenges may impact its performance. Assuming a positive market trajectory, Tether’s value in 2030 may witness incremental growth, potentially surpassing its pegged value.

Tether Price Analysis

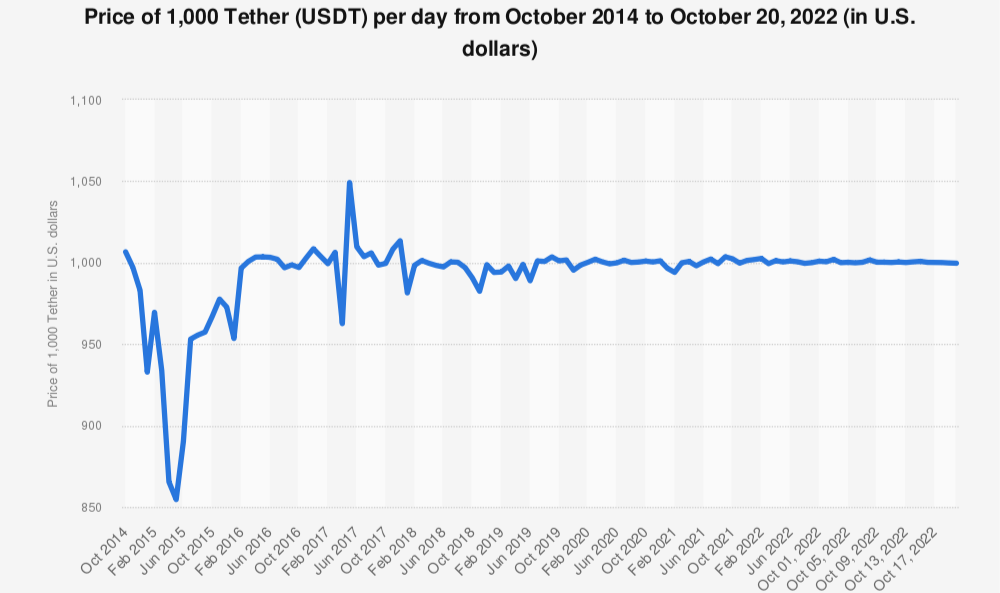

To gain a deeper understanding of Tether’s price movements, a comprehensive analysis is imperative. Analyzing historical price data, trading volumes, and market sentiment can provide valuable insights into potential price patterns. Tether’s price analysis indicates that it has maintained a remarkable stability throughout its existence, making it a reliable hedge during periods of crypto market turbulence. Investors should consider Tether’s price analysis as an essential tool for informed decision-making.

Tether 2022

A retrospective look at Tether’s performance in 2022 shows that it upheld its reputation as a stablecoin amidst market fluctuations. Despite occasional controversies surrounding its reserve transparency, Tether successfully maintained its peg to the US dollar, cementing its position as a pillar of stability in the crypto space. This resilience contributed to its sustained popularity among investors, traders, and DeFi participants.

Tether Price Prediction Conclusion

In conclusion, Tether’s future appears promising, primarily driven by its stability and utility in an increasingly crypto-centric financial landscape. Short-term price movements are likely to remain minimal, staying close to its pegged value throughout 2023. As we move towards 2024 and 2025, an upward trend is plausible, with a possibility of exceeding its pegged value. The long-term forecast for 2030 also indicates potential growth, contingent on broader crypto market conditions and regulatory developments.

FAQs

Tether is considered a safe haven during market volatility, making it an attractive choice for risk-averse investors in 2023.

Tether’s price is primarily influenced by market sentiment, demand for stable assets, and regulatory developments.

In certain scenarios, such as increased adoption and new use cases, Tether’s price may slightly surpass its pegged value.

No, Tether is designed to maintain a stable value, thereby minimizing exposure to market volatility.

While Tether is widely used, there are other stablecoins in the market with their unique features, and the best choice depends on individual preferences and use cases.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.