At the end of the 2021 bull market, Avalanche was on its pathway to becoming one of the most valuable crypto assets on the market. Its extremely scalable and fast blockchain was one of the successful projects last year.

Nonetheless, the bear market has led to massive losses for the AVAX token. However, what does the future AVAX forecast look like?

Technical Analysis

Avalanche price analysis demonstrates that the price is encompassing a downward movement once again. The value dissed to $12.69 as the market had a bearish leeway. The bearish energy has been massive as it has affected the overall price value somewhat negatively.

There’s a prominent possibility of the price going below the $12.15 support level, which could suggest a further price decline in the future. Still, there’s also some resistance present at the $13.15 level that might limit any downward movement.

The trading volume is at $138,101,567, which is quite weak, unlike the overall trading volume in the market. On the other hand, the market cap of AVAX is $3,814,643,918.

Avalanche price analysis of the twenty-four chart demonstrates that the market is in a bearish trend as the prices are also moving downwards. Also, the price has already undergone depreciation even today, which has brought its level down to $12.69, along with a decrease of about $3.90.

Also, the bearish trend has been quite powerful and heavily affected the price of AVAX/USD.

The upper Bollinger band has shifted towards the $20.965 value, and its lower Bollinger band is at the $13.217 value. The RSI is currently at 52.50, which shows the market is neither oversold nor overbought.

On top of that, the moving standard is also positioned at a safer level (for example, $16.309).

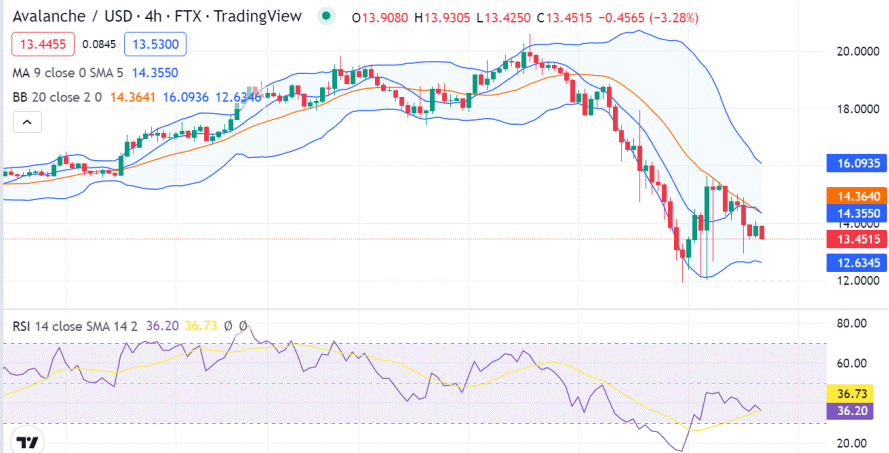

The Avalanche price analysis is moving towards the bearish route as the downtrend has followed as well. The price is moving down due to the bearish momentum, as it’s increasing each hour. Its volatility has been high in the AVAX market. That’s probably the reason the Bollinger bands indicator is at an average of $14.364.

The upper Bollinger band is displayed at a $16.093 value, while the lower Bollinger band displays a $12.634 value. As the price has devalued, the RSI also has shifted to 36.73, which displays a bearish signal.

Also, the moving average value is at 14.355 for the four-hour price chart, which shows that its prices are still down.

Analysis Conclusion

To sum up, it can be confirmed that the bears of Avalanche have been succeeding so far in ruling the market. Its price has gone down to $12.69, which is somewhat of a major loss for the cryptocurrency market.

Possibilities of recovery are very minimal for the buyers as the price has critically gone close to the support level present at the $12.15 mark.

FAQs

Q: How did AVAC do in 2022?

In 2021, AVAX price noticed a huge surge. It reached an all-time high at the end of November 2021 at more than $146. Even after that, the price noticed another peak at the end of December before the bear market triggered the AVAX price to fall sharply.

At the turn of the year, AVAX was still trading at $109 when most other cryptos had seen heavy losses.

Q: Is Avalanche a good investment?

The Avalanche prognosis for the following years is quite optimistic if the project must continue to develop in a great route.

As with most other altcoins, there’s a higher risk here as Avalanche is a relatively young project as well. As such, you could invest in AVAX if you genuinely believe in the project. However, you need to ensure you own a diversified portfolio of cryptocurrencies.

Q: How do you stake AVAX?

You will find numerous exchanges offering AVAX staking. One of the recommended ways is using Binance, as it’s one of the largest and most secure crypto platforms in the globe. On top of that, the current APR for staking on Binance is between 6.28 and 18.9 percent in a locked account.

Q: Is Avalanche better in Ethereum?

Avalanche surpasses Ethereum due to its fast transactions and low fees. Stablecoins can be designed on both exchanges. Remember that stablecoins are cryptos that are linked to an underlying asset, like gold or the US dollar.

Such tokens provide a selection of uses too.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.