Stellar has emerged as one of the most promising blockchain platforms in the cryptocurrency space. With its unique technology and features, Stellar aims to facilitate fast and low-cost cross-border transactions while ensuring transparency and security. In this article, we will delve into the fascinating world of Stellar and conduct a comprehensive price analysis to understand its market behavior and investment potential.

What is Stellar?

Stellar is an open-source blockchain network that enables the issuance and transfer of digital assets, including its native cryptocurrency, XLM. It was founded in 2014 by Jed McCaleb and Joyce Kim, and it is developed and maintained by the Stellar Development Foundation (SDF). Stellar’s primary goal is to facilitate seamless and affordable cross-border transactions, making it an ideal choice for remittances and global payments.

Stellar’s Technology and Features

Stellar’s Blockchain

Stellar operates on a decentralized blockchain, where transactions are recorded on a distributed ledger. The blockchain ensures immutability and transparency, making it trustworthy for various use cases.

Consensus Mechanism

Stellar uses a unique consensus mechanism called the Stellar Consensus Protocol (SCP). Unlike traditional proof-of-work (PoW) or proof-of-stake (PoS) systems, SCP relies on federated Byzantine agreement (FBA), which allows for faster and more efficient transaction validation.

Scalability and Speed

One of the key strengths of Stellar is its ability to process a large number of transactions per second (TPS) quickly. This scalability is achieved through the consensus algorithm and network design, making it an attractive choice for businesses and financial institutions.

Stellar Price Analysis

Historical Price Performance

To assess Stellar’s price potential, let’s take a look at its historical price performance. Over the years, Stellar has experienced significant fluctuations in value. From its humble beginnings, XLM witnessed a remarkable surge during the crypto boom of 2017, reaching an all-time high. However, like many other cryptocurrencies, it also faced a severe correction during the subsequent market downturn.

Factors Influencing Stellar’s Price

The price of XLM is influenced by a multitude of factors. These include:

- Market Sentiment: The overall sentiment towards the crypto market can impact Stellar’s price.

- Regulatory Developments: Changes in regulations can affect Stellar’s adoption and growth.

- Partnerships and Integrations: Collaborations with businesses and financial institutions can boost investor confidence.

- Technology Upgrades: Updates to the Stellar protocol can enhance its functionality and desirability.

Technical Analysis

Technical analysis involves studying historical price charts and trading volumes to identify patterns and trends. Traders use various indicators and chart patterns to make informed decisions. It’s essential to consider resistance levels, support levels, and moving averages when conducting technical analysis.

Fundamental Analysis

Fundamental analysis involves evaluating the underlying factors that can influence an asset’s value. For Stellar, this includes examining its technology, use cases, team, partnerships, and community support. Fundamental analysis helps investors gauge the long-term potential of XLM.

Market Sentiment and News

Market sentiment and news play a vital role in the crypto market’s price movements. Positive news, such as major partnerships or platform upgrades, can lead to price spikes, while negative news can result in sharp declines.

Investment Tips and Strategies

Long-term vs. Short-term Investment

Investors can adopt two primary strategies when it comes to Stellar: long-term or short-term investment. Long-term investors believe in the project’s potential and hold their positions for an extended period, while short-term traders aim to capitalize on short-lived price movements.

Diversification

As with any investment, diversification is crucial. Allocating funds across multiple assets can help mitigate risks associated with individual asset volatility.

Risk Management

Investing in cryptocurrencies carries inherent risks. It’s essential to set clear risk management strategies, such as setting stop-loss orders and avoiding excessive exposure to a single asset.

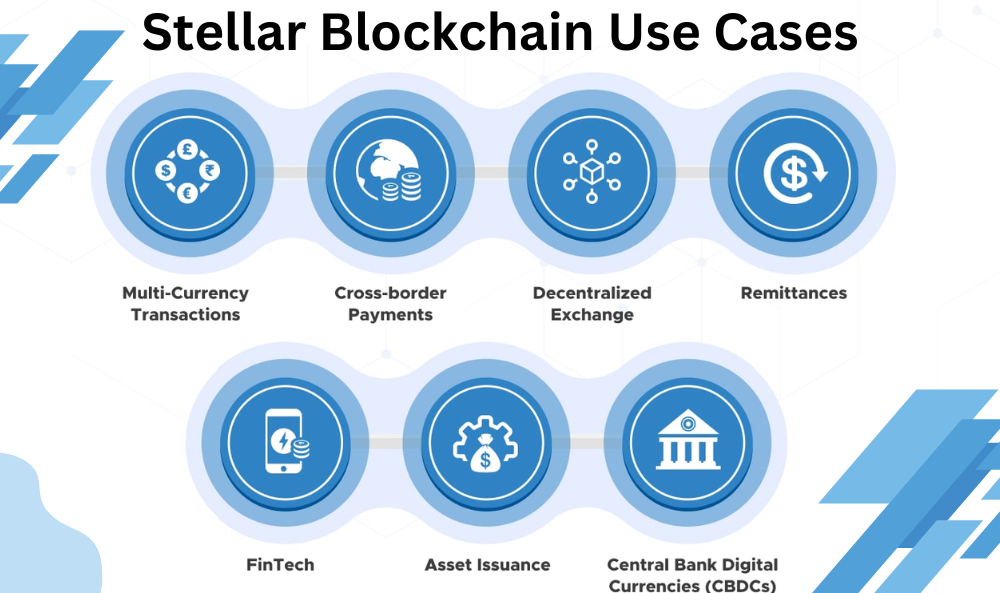

Use Cases of Stellar

Cross-Border Payments

Stellar’s efficient and low-cost transactions make it an excellent choice for cross-border payments. By connecting financial institutions globally, Stellar facilitates faster and cheaper remittances.

Decentralized Exchanges

Stellar enables the creation of decentralized exchanges, allowing users to trade various assets directly on the blockchain without the need for intermediaries.

Micropayments and Remittances

Stellar’s low transaction fees make it suitable for micropayments, making it ideal for various use cases, including remittances and online payments.

Challenges and Future Outlook

Regulatory Environment

The regulatory landscape for cryptocurrencies remains uncertain in many jurisdictions. Changes in regulations can impact Stellar’s growth and adoption.

Competition and Market Trends

Stellar faces competition from other blockchain projects and financial systems aiming to solve similar challenges. Analyzing the competitive landscape is crucial to understanding Stellar’s market positioning.

Stellar’s Roadmap and Upcoming Developments

Stellar’s development team is continually working on improving the platform. Upcoming upgrades and features can influence investor sentiment and price movements.

Conclusion

In conclusion, Stellar presents a compelling option for individuals and businesses seeking efficient and cost-effective cross-border transactions. Its innovative technology and growing adoption indicate promising long-term potential. However, investors should conduct thorough research, consider risk management, and stay informed about market developments before making investment decisions.

FAQs

The price of Stellar (XLM) is constantly changing due to market fluctuations. For the most up-to-date price, check reliable cryptocurrency exchanges or financial news websites.

Stellar differentiates itself by focusing on cross-border payments and connecting financial institutions. Its consensus mechanism and scalability make it stand out in the crypto space.

Yes, Stellar’s low transaction fees and fast settlement times make it suitable for everyday transactions, including small-value purchases.

Investing in cryptocurrencies carries risks, including price volatility, regulatory changes, and technological challenges. It’s essential to conduct due diligence and invest responsibly.

Stellar’s long-term potential depends on its continued development, adoption, and market demand. As with any investment, careful consideration and risk assessment are essential.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.