Welcome to the world of YASA, a leading technology company spearheading the electric vehicle revolution. In this article, we’ll explore YASA’s business overview, their groundbreaking electric motor technology, and their stock forecasts for 2023, 2022, 2021, and 2020. Join us as we uncover the potential of YASA in shaping a cleaner and greener future for transportation.

Contents

Business Overview of YASA

A leading technology company revolutionizing the electric vehicle (EV) industry. Founded in 2009, YASA has been at the forefront of developing innovative electric motor technology, setting new standards for efficiency, performance, and sustainability. With its headquarters in Oxford, UK, YASA has garnered a reputation for providing cutting-edge solutions to various industries, including automotive, aerospace, marine, and industrial applications.

As the demand for electric vehicles continues to surge worldwide, YASA has positioned itself as a key player in the transition towards cleaner and greener transportation solutions. Their proprietary axial-flux electric motor technology has garnered widespread attention and recognition from major automakers, making them a sought-after partner in the EV industry.

YASA Stock Forecast 2023

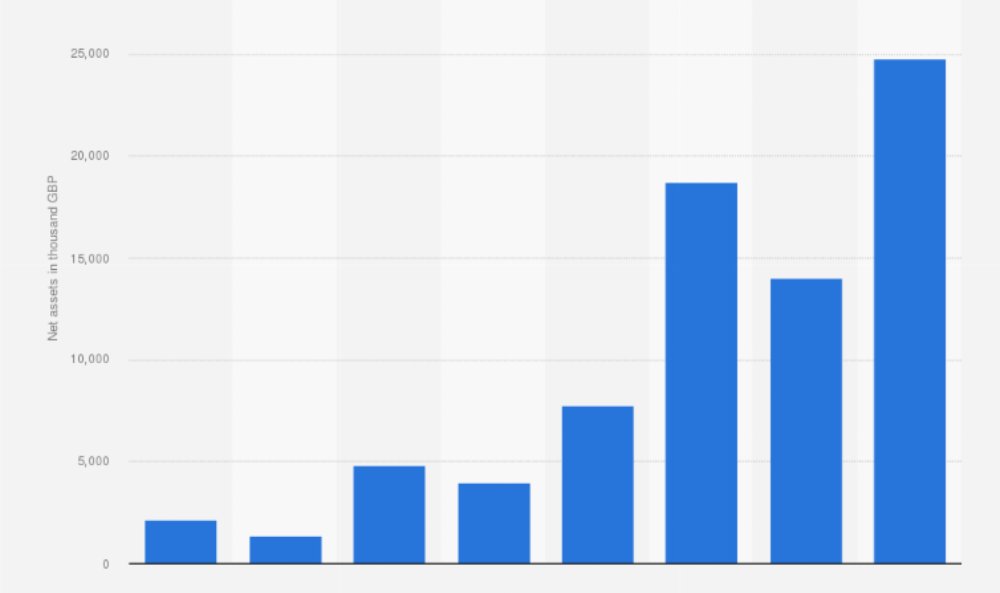

As we step into 2023, YASA’s stock forecast appears highly promising. The company has witnessed substantial growth in recent years, driven by the increasing adoption of electric vehicles and the growing awareness of environmental sustainability. With governments and companies alike pushing for a greener future, YASA’s innovative electric motor technology has become a crucial component in the transition towards electrification.

Analysts predict that YASA’s stock is set to experience a significant uptrend in 2023, with potential bullish trends dominating the market. As electric vehicles become more mainstream and their market share continues to expand, YASA is well-positioned to capitalize on the growing demand for their products. This is expected to reflect positively on their stock performance, making it an attractive investment opportunity for both short-term traders and long-term investors.

YASA Stock Forecast 2022

In retrospect, 2022 was a remarkable year for YASA as it witnessed impressive growth in revenue and market presence. The adoption of electric vehicles accelerated, and YASA’s electric motor technology played a pivotal role in powering many EV models from renowned automakers. This boost in demand led to a surge in YASA’s stock price, much to the delight of investors.

Though the market may have experienced fluctuations and temporary corrections, YASA’s performance demonstrated resilience, and it managed to weather the storm of volatility. This reflects the confidence investors have in YASA’s innovative technology and its potential for long-term success.

YASA Stock 2021

The year 2021 was a turning point for YASA as it saw its technology gaining traction and recognition in the electric vehicle industry. YASA secured strategic partnerships with major automotive manufacturers, enabling them to integrate their electric motor technology into a wide range of electric vehicles. As a result, YASA’s revenue surged, and investors took note of the company’s growth potential.

The stock price in 2021 showed positive movement, driven by increasing market confidence in YASA’s technology and its ability to stay ahead in the fiercely competitive EV market. The positive outlook for electric vehicles and YASA’s role as an enabler of this transition bode well for the company’s stock performance in 2021.

YASA Stock 2020

Amidst the challenges and uncertainties brought on by the global pandemic in 2020, YASA remained resilient and adapted swiftly to the changing market dynamics. The electric vehicle industry faced disruptions, but YASA’s strong foundation and continuous innovation allowed it to maintain a steady growth trajectory.

The demand for cleaner and sustainable transportation solutions gained momentum during this time, with a greater emphasis on reducing carbon emissions. YASA’s electric motor technology aligned perfectly with these demands, and the company’s stock performance remained steady during this period, laying the groundwork for future growth.

Conclusion

In conclusion, YASA’s stock forecast looks promising, with an upward trajectory expected to continue into 2023 and beyond. The company’s dedication to developing cutting-edge electric motor technology has positioned it as a prominent player in the electric vehicle industry. As the world embraces cleaner and more sustainable transportation solutions, YASA is poised to capitalize on this shift and drive significant growth in the market.

Investors are increasingly recognizing the potential of YASA as a long-term investment opportunity, considering the rising demand for electric vehicles and the essential role YASA’s technology plays in this transformative industry. While the market may experience fluctuations, YASA’s strong business fundamentals and innovative solutions make it a robust choice for investors seeking exposure to the EV sector.

FAQs

YASA’s axial-flux electric motor technology offers higher efficiency and power-to-weight ratios, making it ideal for various applications, especially electric vehicles.

YASA’s technology finds applications in automotive, aerospace, marine, and industrial sectors.

Yes, YASA is a publicly-traded company, and its stock is available for investment on major stock exchanges.

YASA’s commitment to continuous innovation and its ability to forge strategic partnerships with major automakers set it apart in the electric vehicle technology space.

By enabling the electrification of transportation, YASA plays a crucial role in reducing carbon emissions and promoting a greener future.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.