The realm of biotechnology has been revolutionized by the advent of mRNA technology, a groundbreaking approach that has transformed how we think about medicine and therapeutics. At the forefront of this innovation is Moderna Inc., a biotech firm that has become synonymous with the rapid development of mRNA-based vaccines, particularly in the fight against COVID-19.

The Science Behind mRNA Technology

Messenger RNA, or mRNA, is a type of RNA that carries genetic information from DNA to the protein-making machinery of cells. Unlike traditional vaccines that introduce an inactivated or weakened form of a virus to stimulate an immune response, mRNA vaccines teach our cells how to make a protein that triggers an immune response. This innovative method has proven to be highly effective and has paved the way for rapid vaccine development in response to emerging health threats.

Moderna’s Role in the mRNA Market

Moderna Inc. has emerged as a leader in mRNA technology, with its stock symbol MRNA becoming a symbol of hope and scientific progress. The company’s swift response to the COVID-19 pandemic, resulting in one of the first authorized mRNA vaccines, has not only saved countless lives but also positioned Moderna as a key player in the pharmaceutical industry.

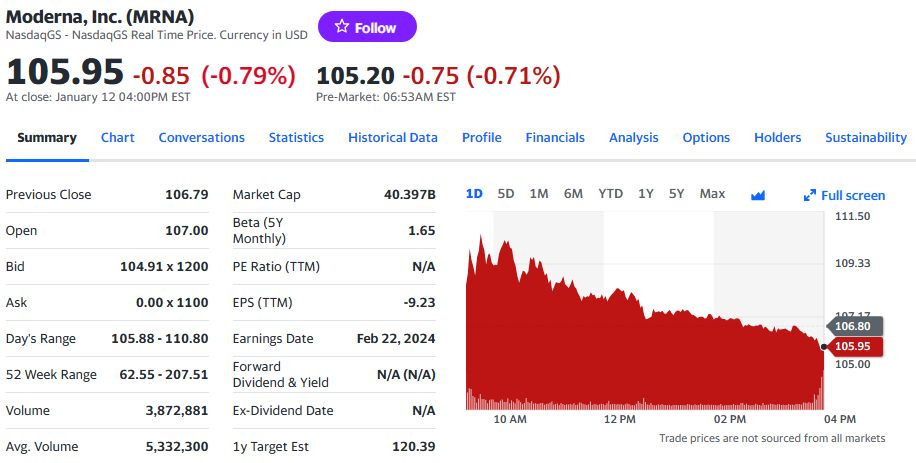

As of the latest update, Moderna’s stock price stands at $105.95, reflecting the dynamic nature of the biotech market1. Investors and analysts closely monitor the company’s stock, as it is seen as a barometer for the potential of mRNA technology in various therapeutic applications beyond vaccines.

Moderna’s Financial Health: A Deep Dive

Moderna Inc.’s financial performance is a critical aspect for investors considering mRNA stock. The company’s ability to generate revenue and manage expenses directly impacts its stock value and investor confidence.

Analyzing Moderna’s Recent Financial Performance

In 2023, Moderna reported product sales of approximately $6.7 billion, with a significant portion stemming from its COVID-19 vaccine sales. This figure represents a substantial financial achievement for the company, showcasing its capacity to capitalize on its mRNA technology. However, looking ahead to 2024, Moderna has projected product sales of around $4 billion, primarily driven by continued COVID-19 vaccine sales and the anticipated launch of its RSV vaccine.

Revenue Streams and Investment Potential

Moderna’s revenue streams are diversified across its therapeutic and vaccine programs. With 45 programs in development and nine in late-stage development, the company is well-positioned to expand its portfolio. The expected sales growth in 2025 and the projection to break even in 2026 highlight the company’s strategic planning and investment potential.

The table below summarizes Moderna’s financial outlook:

| Year | Product Sales | COVID-19 Market Share | Expected Growth |

|---|---|---|---|

| 2023 | $6.7 billion | 48% | – |

| 2024 | $4 billion | – | – |

| 2025 | – | – | Return to growth |

| 2026 | – | – | Break even |

Investors should note that while the projected decrease in sales for 2024 may seem concerning, it is part of Moderna’s calculated approach to resizing its COVID-19 manufacturing for an endemic setting and preparing for new product launches. The company’s financial health remains robust, with cash reserves exceeding $13 billion at the end of 2023.

2024 mRNA Stock Forecast: What Experts Say

The financial landscape of Moderna is closely watched by industry experts, who provide valuable insights into the company’s stock performance. Their analysis and predictions are essential for investors looking to understand the potential growth and risks associated with mRNA stock.

Summarizing Analyst Predictions and Price Targets

As we move into 2024, analysts have set a variety of price targets for Moderna’s stock. The consensus among experts suggests a positive outlook, with an average price target of $129.75, indicating a potential upside from the current price. Some analysts are even more optimistic, with high forecasts reaching up to $231.00, while more conservative estimates place the target at around $60.00.

Understanding the Factors Influencing Forecasts

Several factors contribute to these forecasts, including Moderna’s robust pipeline of mRNA-based therapies and vaccines, its financial health, and the overall market conditions. Analysts consider the company’s ability to innovate and bring new products to market, as well as external influences such as regulatory changes and global health developments.

The table below presents a snapshot of the analyst predictions for Moderna’s stock in 2024:

| Analyst Consensus | Average Price Target | High Forecast | Low Forecast |

|---|---|---|---|

| Hold | $129.75 | $231.00 | $60.00 |

These predictions reflect the dynamic nature of the biotech industry and the high stakes involved in investing in companies like Moderna. As we examine the company’s research pipeline and strategic moves, we’ll gain a clearer picture of the potential trajectory for mRNA stock in the coming year.

Moderna’s Pipeline: Future Prospects and Challenges

Moderna’s research pipeline is a beacon of innovation, with numerous projects that could redefine the landscape of modern medicine. The company’s commitment to mRNA technology has opened doors to potential treatments for a variety of diseases.

Upcoming Products and Research Developments

As of 2024, Moderna has a robust pipeline with 45 therapeutic and vaccine programs, including nine in late-stage development. These programs target a range of conditions, from respiratory syncytial virus (RSV) and influenza to more personalized therapies like individualized neoantigen therapy (INT) for cancer. The anticipated milestones for these programs in the coming year are eagerly awaited by the medical community and investors alike.

Potential Hurdles in the Pharmaceutical Landscape

While the prospects are promising, Moderna faces challenges common to the pharmaceutical industry. Regulatory hurdles, competition, and the need for continuous innovation are just a few of the obstacles that could impact the company’s progress. However, Moderna’s strategic investments and partnerships, such as the construction of the UK’s first mRNA vaccine research and manufacturing center, position the company to overcome these challenges and remain at the forefront of mRNA technology.

The table below highlights some of the key programs in Moderna’s pipeline:

| Program | Target Condition | Development Stage |

|---|---|---|

| RSV Vaccine | Respiratory Syncytial Virus | Late-stage |

| INT Therapy | Cancer | Late-stage |

| Influenza Vaccine | Influenza | Late-stage |

The success of these programs will not only benefit public health but also have a significant impact on Moderna’s financial performance and stock value. As we continue, we will explore the market sentiment surrounding Moderna and how investor perceptions are shaping the company’s stock outlook.

Investor Sentiment: Reading the Market Signals

Investor sentiment plays a pivotal role in shaping the stock market, and Moderna’s stock is no exception. The perception of the company’s future performance can significantly influence its stock price.

Evaluating Market Sentiment and Investor Confidence

The recent upgrade by Oppenheimer to an “outperform” rating reflects growing confidence in Moderna’s pipeline potential. This positive sentiment is bolstered by the company’s CEO, Stéphane Bancel, reiterating the expectation for sales growth to reignite by 2025. Such endorsements from analysts and company executives can lead to increased investor interest and a more favorable outlook for the stock.

Impact of Global Events on Stock Performance

Global events, such as health crises or regulatory changes, can have a profound impact on biotech stocks like Moderna. The company’s ability to navigate these events, as evidenced by its successful COVID-19 vaccine and ongoing development of an RSV vaccine, has been a key factor in maintaining investor trust. As Moderna continues to adapt to the evolving healthcare landscape, investor sentiment is likely to remain a critical indicator of the company’s stock performance.

The table below illustrates the recent market signals and their potential impact on Moderna’s stock:

| Event | Analyst Rating | CEO Statement | Potential Impact |

|---|---|---|---|

| Oppenheimer Upgrade | “Outperform” | Sales growth expected in 2025 | Positive |

| Global Health Developments | – | RSV vaccine launch anticipated | Positive |

Strategic Moves: Moderna’s Business Acumen

Moderna’s strategic business decisions in 2024 are shaping the company’s trajectory and reinforcing its position as a leader in mRNA technology. The company’s approach to growth, investment, and partnerships reflects a commitment to innovation and a vision for the future of medicine.

Partnerships, Mergers, and Acquisitions

In a move to expand its global reach and capabilities, Moderna has recently acquired Japanese biotech OriCiro Genomics for $85 million. This acquisition is expected to enhance Moderna’s mRNA synthesis process, reducing the time from design to product readiness. Additionally, Moderna’s long-term collaboration with Thermo Fisher Scientific continues to support its development pipeline with clinical research and contract manufacturing services.

Moderna’s Strategy for Sustained Growth

Moderna is laying out a significant capital expenditure (CAPEX) of $900 million in 2024 to drive its growth ambitions. This investment will support the company’s expansion into different disease categories and the launch of up to 15 products in the next five years. With a focus on returning to sales growth in 2025 and breaking even in 2026, Moderna is preparing for the launch of its RSV vaccine and other late-stage programs.

The table below outlines Moderna’s strategic initiatives and their expected impact:

| Initiative | Description | Expected Impact |

|---|---|---|

| OriCiro Acquisition | Enhancing mRNA synthesis process | Streamlined production |

| Thermo Fisher Collaboration | Supporting development pipeline | Sustained innovation |

| CAPEX Investment | Expanding disease category reach | Growth and product launches |

Through these strategic moves, Moderna is not only advancing its mRNA platform but also setting the stage for continued financial success and market leadership. The company’s ability to execute on these plans will be a key factor in its stock performance and investor confidence in the years to come.

FAQs

The current price of Moderna’s stock is $105.95.

Analysts predict an average price target of $129.75 for Moderna’s stock in 2024, with some forecasts reaching up to $231.00

As of now, Moderna does not pay dividends on its mRNA stock.

Key factors include Moderna’s pipeline of mRNA-based therapies and vaccines, its financial health, market conditions, and global events impacting the healthcare industry

Investor sentiment has been positive, with recent upgrades by analysts and endorsements from company executives contributing to a favorable outlook for the stock.

Conclusion

As we conclude this article, it’s essential to remember that investing in the stock market carries inherent risks. While Moderna’s mRNA stock has shown promise and potential for growth, it’s important to conduct thorough research and consult with a financial advisor before making any investment decisions. Based on the latest trends and expert predictions, Moderna’s mRNA stock is poised for continued growth and innovation. The company’s pipeline of mRNA-based therapies and vaccines, strategic business decisions, and financial health are all factors that contribute to its market momentum. Investors should consider the risks and rewards of investing in Moderna’s mRNA stock and weigh them against their financial goals and risk tolerance. With a focus on informed decision-making and a long-term investment strategy, investors can navigate the dynamic landscape of the biotech industry and capitalize on the potential of mRNA technology.

Thank you for reading, and we hope this article has provided valuable insights into Moderna’s market momentum and future prospects.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.