Devon Energy Corporation, a leading independent oil and natural gas exploration and production company, has been making headlines in the energy sector. With operations focused onshore in the United States, Devon’s portfolio of oil and gas properties provides stable, environmentally responsible production and a platform for future growth.

As of January 11, 2024, the company’s stock price was at $43.59. However, the stock market is a dynamic entity, and prices can fluctuate based on a variety of factors. In this article, we will explore the recent performance of Devon Energy’s stocks, also known as DVN stocks, and what the future holds for them.

Recent Performance of DVN Stocks

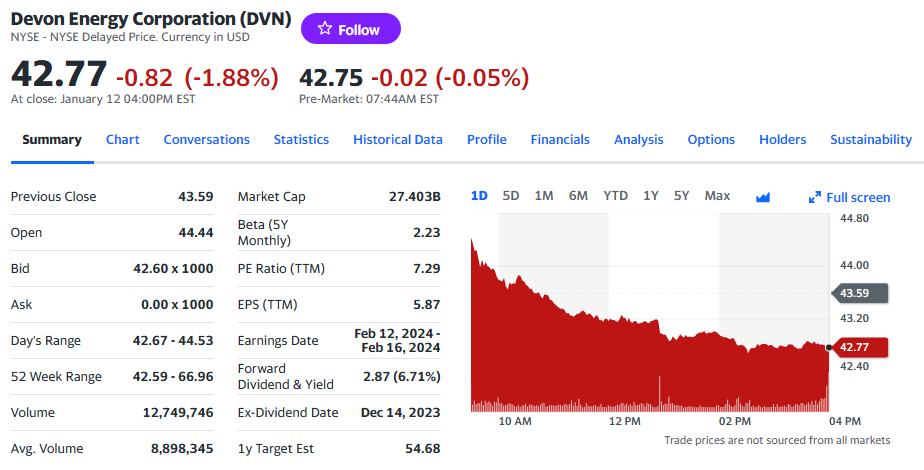

The performance of a company’s stocks is a reflection of its financial health and market position. For Devon Energy, the recent trends in DVN stock prices have been noteworthy. As of January 16, 2024, the DVN stock price stands at $42.77, showing a slight decrease from its previous close.

In the past five trading sessions, the company’s stock price has seen a 0.07% increase, indicating a positive market response despite recent market volatility. However, it’s important to note that stock prices are influenced by a multitude of factors, including global events, market conditions, and company-specific news.

DVN Stock Performance Analysis

Devon Energy’s stock performance is a key indicator of its financial health and market position. As of January 16, 2024, the DVN stock price stands at $42.77. However, stock prices are influenced by a multitude of factors, including global events, market conditions, and company-specific news.

Recent Trends in DVN Stock Prices

In the past month, DVN stocks have seen a slight decrease from its previous close. Despite this, the company’s stock price has seen a 0.07% increase in the past five trading sessions, indicating a positive market response.

Comparison with Industry and Market Averages

When analyzing DVN’s stock performance, it’s important to consider the performance of the overall market and the industry. In the past month, DVN stocks have fallen by 1.95%, leading the Oils-Energy sector’s loss of 5.73% and the S&P 500’s loss of 3.58%. Despite these losses, DVN stocks have risen by 3.39% in the past month, leading the Oils-Energy sector’s gain of 2.41%.

Factors Influencing DVN Stocks

The performance of DVN stocks is influenced by a variety of factors. These range from global events and market conditions to company-specific news and developments.

Global Events and Market Conditions

Global events and market conditions play a significant role in the performance of stocks. Economic indicators, geopolitical events, and changes in market sentiment can all impact stock prices. For instance, the ongoing global energy transition and the push towards renewable energy sources could have implications for Devon Energy, given its focus on oil and gas exploration.

Company-Specific News and Developments

Company-specific news and developments also have a direct impact on stock performance. This includes financial results, strategic decisions, and operational developments. For example, Devon Energy’s recent merger with WPX Energy could influence its stock performance, as mergers often lead to operational synergies and cost savings.

Analysts’ Predictions and Price Targets

When it comes to predicting the future performance of DVN stocks, analysts play a crucial role. Their predictions are based on a thorough analysis of the company’s financial health, market conditions, and industry trends.

Overview of Analysts’ Predictions

Analysts have given a consensus rating of Moderate Buy for Devon Energy stock. This rating is based on the current 5 hold ratings and 11 buy ratings for DVN. These ratings reflect the analysts’ confidence in the company’s future performance.

Discussion on the Price Targets Set by Analysts

Analysts have set an average twelve-month price prediction for Devon Energy at $57.24. The highest price target set is $77.00, and the lowest is $48.00. These price targets suggest a potential upside for DVN stocks.

Investment Potential of DVN Stocks

Investing in stocks always comes with a degree of risk and potential. When it comes to DVN stocks, there are several factors that potential investors should consider.

Analysis of the Investment Potential

Devon Energy’s robust oil production growth and strategic acquisitions bolster its market position. The company’s share repurchase programs and consistent dividend payments underscore a strong commitment to shareholder returns. Investments in joint ventures like Catalyst and Water JV expand operational capabilities and resource management.

However, the company’s reliance on commodity markets exposes it to risks associated with price fluctuations, which can significantly impact revenue and profitability. Moreover, market volatility and environmental regulations present ongoing challenges for the energy sector.

Risks Associated with DVN Stocks

While Devon Energy has demonstrated a solid operational performance, with a 9% increase in oil production year over year, its stock price has trended in the opposite direction of close competitors. This could be attributed to a variety of factors, including global events, market conditions, and company-specific news.

FAQs

As of January 16, 2024, the DVN stock price stands at $42.77.

The performance of DVN stocks is influenced by global events, market conditions, and company-specific news and developments.

Analysts have given a consensus rating of Moderate Buy for Devon Energy stock. They have set an average twelve-month price prediction for Devon Energy at $57.24.

Devon Energy’s robust oil production growth, strategic acquisitions, share repurchase programs, and consistent dividend payments underscore its investment potential. However, risks associated with price fluctuations and market volatility should also be considered.

Risks include the company’s reliance on commodity markets, which exposes it to price fluctuations, and the challenges presented by market volatility and environmental regulations.

Conclusion

Devon Energy Corporation, a key player in the energy sector, has shown robust oil production growth and strategic acquisitions. The performance of its stocks, DVN, is influenced by global events, market conditions, and company-specific news. Analysts have given a consensus rating of Moderate Buy for DVN stocks, with an average twelve-month price prediction of $57.24. However, potential investors should consider the risks associated with price fluctuations and market volatility. In conclusion, while DVN stocks present promising investment potential, understanding the influencing factors and market conditions is crucial for informed investment decisions. As the energy sector evolves, staying updated with the latest trends and developments will be key to navigating the dynamic world of energy stocks.

Fintech-Insight is dedicated to delivering unbiased and dependable insights into cryptocurrency, finance, trading, and stocks. However, we must clarify that we don't offer financial advice, and we strongly recommend users to perform their own research and due diligence.